e-Invoicing Solutions

Home » Solutions » Document Management » e-Invoicing

Manage your invoices electronically with proper compliance

With 25 years of experience in EDI and e-invoicing, B2BE makes managing invoices across different countries easy. No matter where you operate, our global team of experts keep everything up to date. Compliance is our priority so you don’t have to worry about local and regional regulations.

Our expertise spans across several countries around the world following country-specific mandates:

- Australia

- Belgium

- France

- Germany

- Malaysia

- Philippines

- Netherlands

- New Zealand

Challenges solved with B2BE’s e-Invoicing solution

Regulatory Compliance

Adapting to constantly changing regulations across various countries is a resource-intensive process. Each country has its own e-invoicing standards, formats, and tax requirements, making compliance across multiple jurisdictions a complex and time-consuming task.

Data Security & Privacy

Protecting sensitive data from cyber threats and breaches is a critical but challenging requirement. Additionally, complying with stringent privacy laws such as GDPR adds further complexity to managing client data securely and efficiently.

System Integration

Integrating e-invoicing solutions with diverse ERP, accounting, and legacy systems often requires significant effort. Older systems, in particular, may lack compatibility, requiring customisation and additional technical resources to ensure seamless functionality.

Scalability & Performance

Handling large transaction volumes, especially during peak periods, can strain systems and require extensive scaling. Ensuring fast processing and low latency across regions is crucial for real-time reporting but can be difficult to achieve consistently.

Operational Support

Balancing varied client expectations for speed and customisation presents ongoing challenges. Providing round-the-clock support across multiple time zones adds another layer of operational complexity, demanding significant resources.

Cost Management

Maintaining a robust infrastructure, including secure servers and compliance teams, comes with high operational costs. Additionally, staying competitive in the market requires continuous investment in innovative technologies and tools.

Key features of B2BE’s e-Invoicing solution

Real-Time Compliance Updates

Stay compliant with evolving tax regulations through real-time updates. The platform supports country-specific e-invoicing formats, tax rules, and Continuous Transaction Controls (CTC) models like clearance and real-time reporting.

Seamless System Integration

Effortlessly integrate with ERP, accounting, and legacy systems, ensuring smooth operations without disruptions. The solution also supports API-based connectivity and multiple data formats, including XML, JSON, and UBL, for versatile connectivity.

Automated Invoice Processing

Streamline invoicing with automation for invoice creation, validation, and submission. Automated workflows manage approvals and exceptions, while notifications alert you to errors or status changes, reducing manual intervention.

Multi-Country Invoicing Capabilities

Simplify cross-border transactions with multi-language and multi-currency support. The e-invoicing solution handles complex tax rules and formats across countries, ensuring compliance for businesses operating globally.

Secure Data Management

Ensure legal and secure storage of invoices with end-to-end encryption and advanced data validation. The system is audit-ready, enabling easy retrieval of documents while maintaining strict compliance.

Real-Time Dashboards and Analytics

Gain valuable insights with real-time dashboards that track invoice status and compliance adherence. Customisable analytics offer detailed payment trends and financial insights, helping drive informed business decisions.

What you can achieve with B2BE's e-Invoicing solution

Cost Efficiency

- Reduced IT Investment: Lowers costs associated with in-house setup and maintenance of e-Invoicing systems.

- Scalability: Scales as your business grows, reducing the need for additional infrastructure.

Regulatory Compliance

- Up-to-Date Compliance: Ensures adherence to evolving tax regulations and standards in multiple countries.

- Local Expertise: Access to local and global compliance knowledge to meet country-specific mandates (e.g., VAT, CTC models).

Efficiency & Automation

- Streamlined Processes: Automates invoicing processes, reducing manual intervention and errors.

- Integration with ERP Systems: Provides seamless integration with existing ERP, accounting, and finance systems.

Data Security & Accuracy

- Enhanced Security: Ensures high levels of data security, protecting sensitive information.

- Reduced Errors: Minimises human errors through automated data validation and standardisation.

Faster Implementation

- Quick Setup: Reduces the time needed to implement e-invoicing, with ready-to-use platforms and experienced support.

- User Support & Training: Provides ongoing support and user training for efficient usage.

Access to Advanced Features

- Analytics & Reporting: Offers advanced reporting and analytics tools for better financial insights.

- Workflow Customisation: Customises workflows to match unique business needs.

(Continuous transaction controls) CTC Models

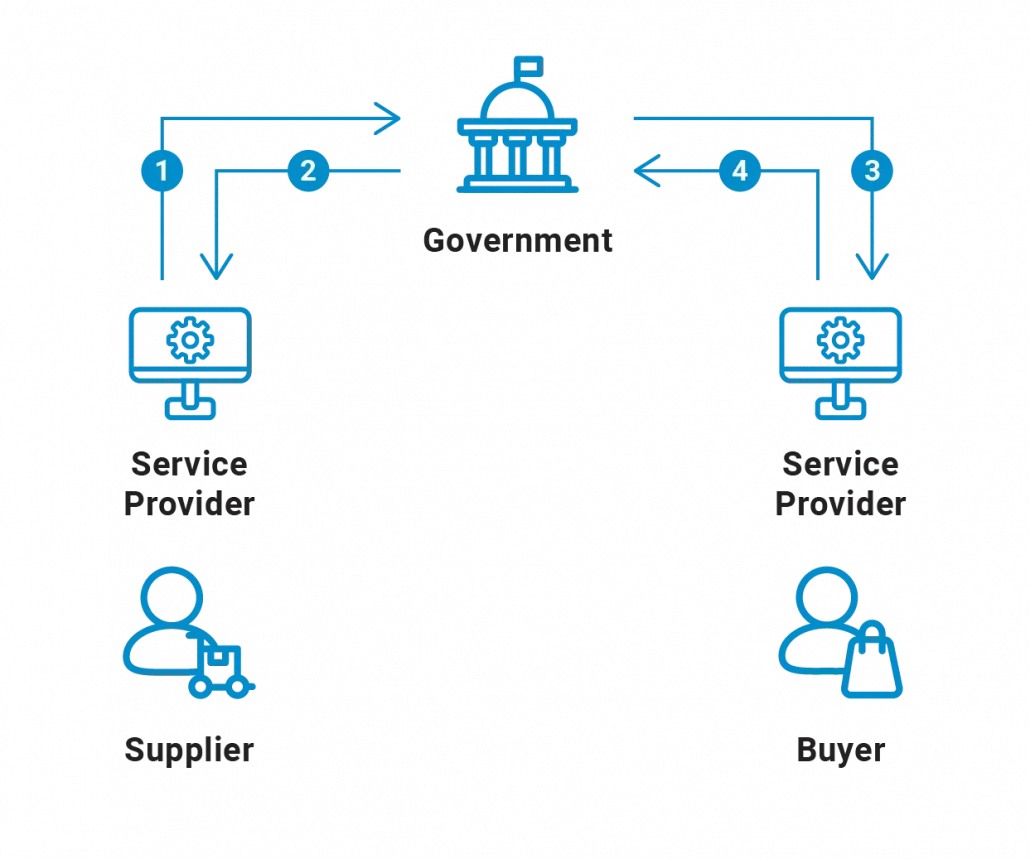

Real-Time Reporting

- Immediate reporting of transactions to tax authorities.

- Enables instant compliance checks and validations.

- Increases transparency and helps prevent tax evasion.

- Provides real-time data to authorities.

Countries of interest

- Hungary

- South Korea

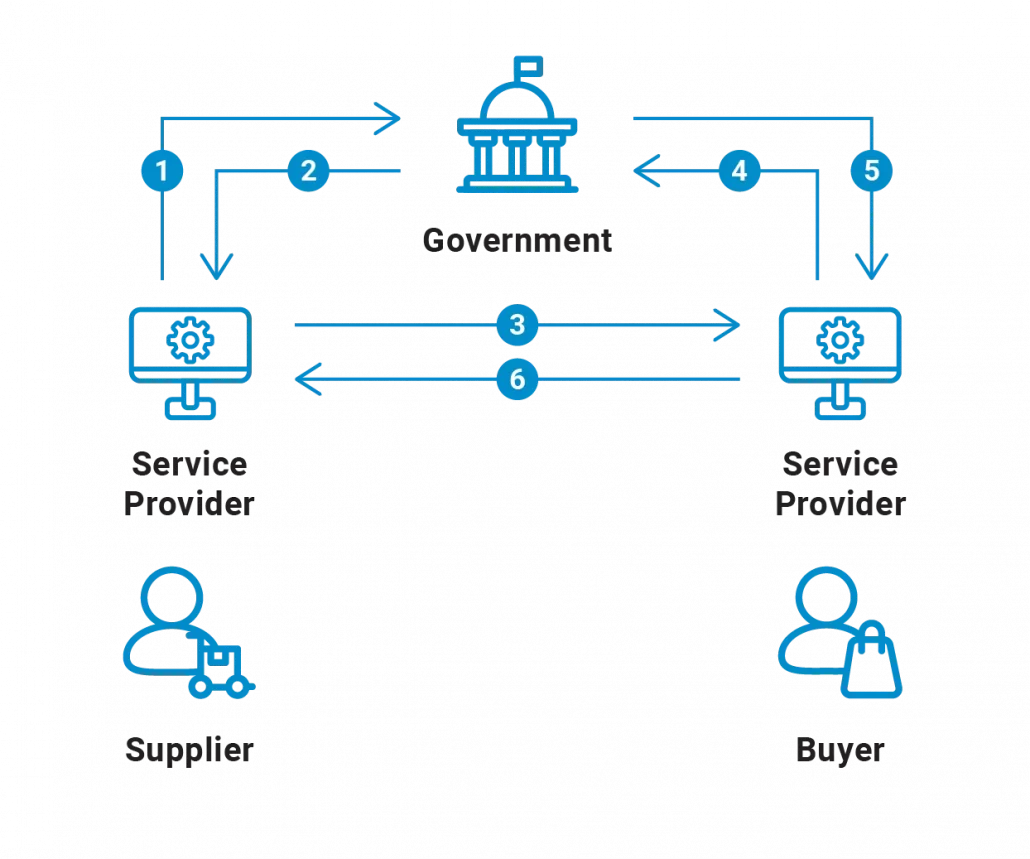

Centralised Exchange

- Transaction data is collected and processed through a central platform.

- Simplifies compliance and enforcement for tax authorities.

- Requires robust infrastructure and data management capabilities.

Countries of interest

- Belgium

- Brazil

- Turkey

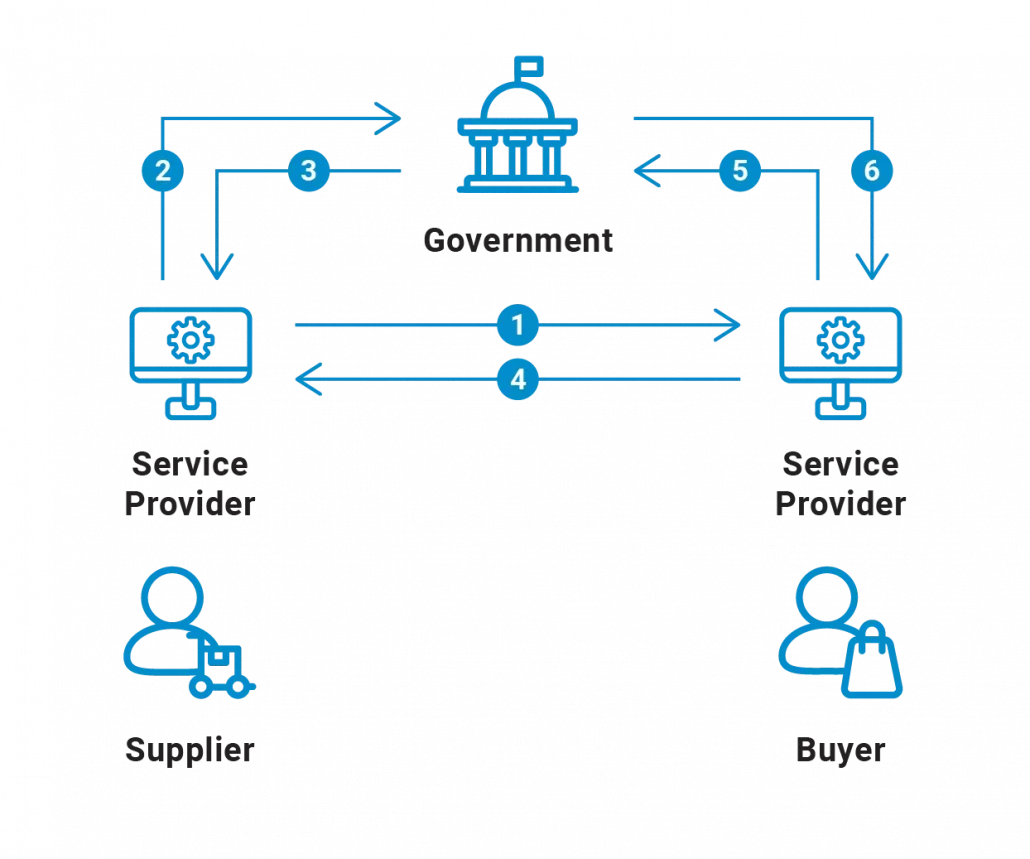

Clearance

- Transactions require approval by tax authorities before completion.

- Ensures only compliant e-invoicing transactions are processed.

- Maintains strict control over tax evasion and fraud.

Countries of interest

- Mexico

- Chile

- India

- Saudi Arabia

- Southeast Asia

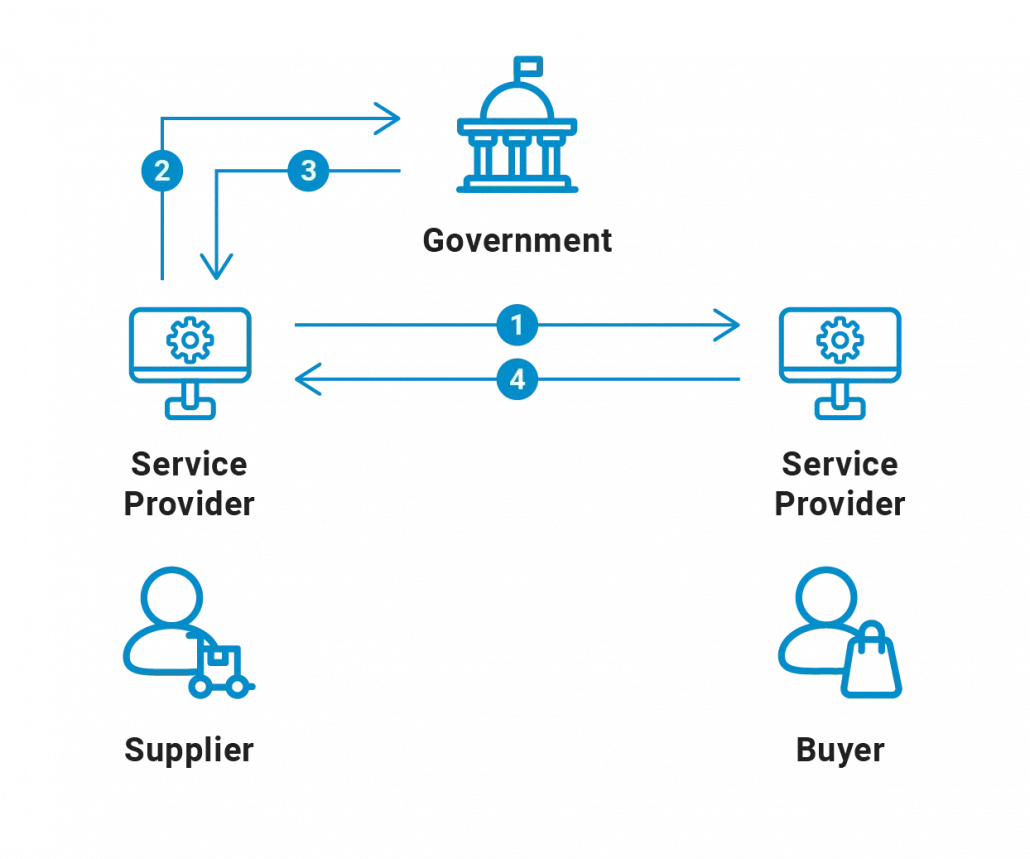

Decentralised

- Combines multiple service providers with central governance standards.

- Offers flexibility and scalability while ensuring compliance.

- Supports a network of service providers adhering to common standards for interoperability and data exchange.

Countries of interest

- Norway

- Sweden

- Germany