最新动态

最新消息

B2BE launches Managed Customer Invoice Distribution solution

Thursday, 6 March 2025. InterContinental Hotel, One Hamilton Place, Park Lane, LONDON W1J 1QY.

B2BE are proud to be sponsoring the EDA’s annual Digitalisation Forum & Data Quality Awards 2024 taking place on 5 December 2024 at the America Square Conference Centre…

对于希望改善现金流管理的企业来说,这是一个令人振奋的消息!我们非常高兴地宣布B2BE推出了最新解决方案 - 动态折扣...

Everything you need to know about the 2024 e-invoicing mandate in France

B2BE are excited to announce that we have partnered with the Electrical Distributors Association (EDA). The EDA is the trade association in the UK for electrical wholesalers and distributors. They believe in highlighting the important link between distributors of electrotechnical products, manufacturers, electricians, and electrical contractors.

Amsterdam-based online supermarket Crisp has experienced continued growth in its business. This will allow greater success across the Netherlands and before hopefully expanding the organisation through Europe. To meet the new challenges and opportunities ahead, Crisp has joined forces up with B2BE to manage their communication and data transmission with an ever-increasing network of suppliers and other supply chain partners.

Upcoming news

EDA Annual Awards Dinner, London

Thursday, 6 March 2025

|

InterContinental Hotel, One Hamilton Place, Park Lane, LONDON W1J 1QY.

电子发票新闻

自 2024 年 11 月起强制实施 PINT A-NZ

The Peppol PINT format is an international invoice specification introduced by Open Peppol in early 2023. Since then, this format has been adopted by Japan,

自 2024 年 11 月起强制实施 PINT A-NZ

The Peppol PINT format is an international invoice specification introduced by Open Peppol in early 2023. Since then, this format has been adopted by Japan,

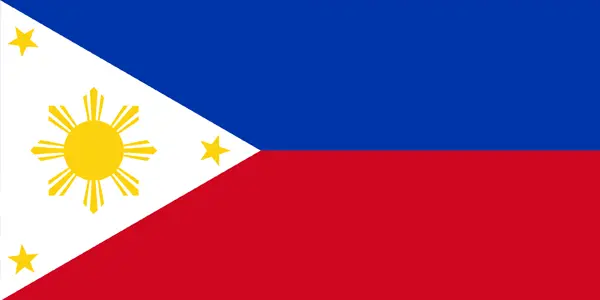

因技术挑战,英国国家保险局暂停 EIS 电子发票系统试点工作

The Philippines launched its Electronic Invoicing/Receipting System (EIS) pilot in July 2022, requiring selected taxpayers to report issued invoices in real-time using the EIS platform.

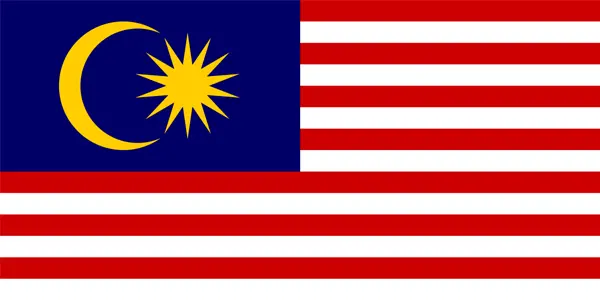

马来西亚正在逐步实施电子发票,到 2025 年 7 月,所有纳税人都将被纳入其中。

e-Invoicing in Malaysia is being gradually implemented with all taxpayers to be included by July 2025 The Malaysian Inland Revenue Board announced a 6-month grace